Tokenomics

1. Introduction

The HDN token is a utility and governance token of the Hydranet DAO (decentralized autonomous organization). It enables:

- DAO governance participation (live now)

- Tiered trading fee reductions on the Hydranet DEX platform (planned to go live within 6 months after mainnet release)

- Collateralization to run crucial network services, e.g., Titans and Guardians (planned to go live within 12 months after mainnet release)

HDN is an ERC-20 token on the Arbitrum One blockchain. Its supply is capped at 300 million, with unreleased tokens held in a DAO-controlled vault. Up to 5 million HDN per proposal may be unlocked, subject to approval by the DAO

2. HDN Use Cases

HDN holders can run Hydranet Network services, benefit from reduced trading fees, and participate in Hydranet DAO governance.

The DAO will continue exploring new technical and legally viable use cases for HDN as the network evolves.

2.1 Collateral for Hydranet Network Services

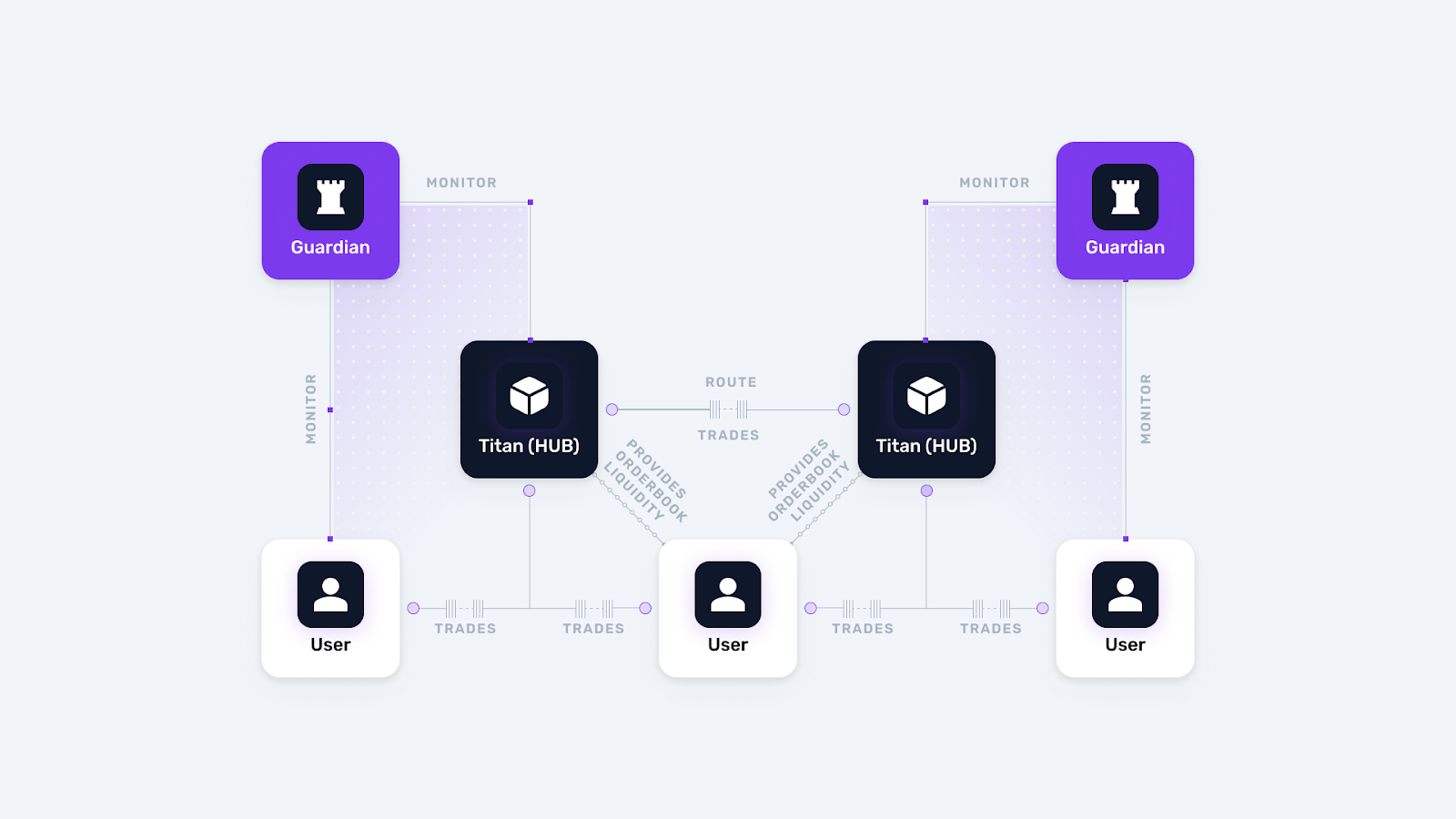

To support decentralization, the Hydranet Network will be upheld by two core node types: Hubs and Watchtowers, referred to as Titans and Guardians respectively.

- Titans (Hubs)

Operate the off-chain DEX infrastructure by maintaining order books and handling trade routing between users - Guardians (Watchtowers)

Monitor the network and enforce protocol integrity through surveillance, dispute resolution, and by penalizing detected malicious behavior

HDN holders can operate these roles by temporarily locking collateral:

- Titans: 1,000,000 HDN

- Guardians: 120,000 HDN

In return, operators receive a dedicated share of the trading fees generated by the Hydranet DEX. Read more in Section 3.

Current network analysis indicates a ratio of approximately 10 Guardians for each Titan in the first year.

2.2 Trading Fee Reduction (planned)

Holding HDN in a Hydranet wallet will grant users tiered discounts on the platform’s trading fees.

HDN-based fee discounts apply only to positive trading fees and do not increase rebates on negative-fee trades.

| HDN balance | Trading fee reduction |

|---|---|

| 5,000 - 25,000 | 2.5 % |

| 25,001 - 75,000 | 5 % |

| 75,001 - 150,000 | 10 % |

| 150,001 - 250,000 | 15 % |

| 250,001 - 500,000 | 20 % |

| > 500,000 | 25 % |

Note: Figures and ratios are subject to change by the Hydranet DAO. Changes up to 25% can be implemented without a vote; larger changes require DAO approval.

2.3 DAO Governance

HDN grants voting rights within the Hydranet DAO. Using Snapshot, each token equals one vote, enabling a fair and decentralized decision-making process.

2.4 HDN as Ecosystem Payment Option (planned)

HDN will function as the preferred medium of payment within the Hydranet ecosystem. Users paying in HDN benefit from reduced costs (e.g., 25% discount on channel rental fees). Planned use cases include:

- Token listing fees

- Channel rental fee payments

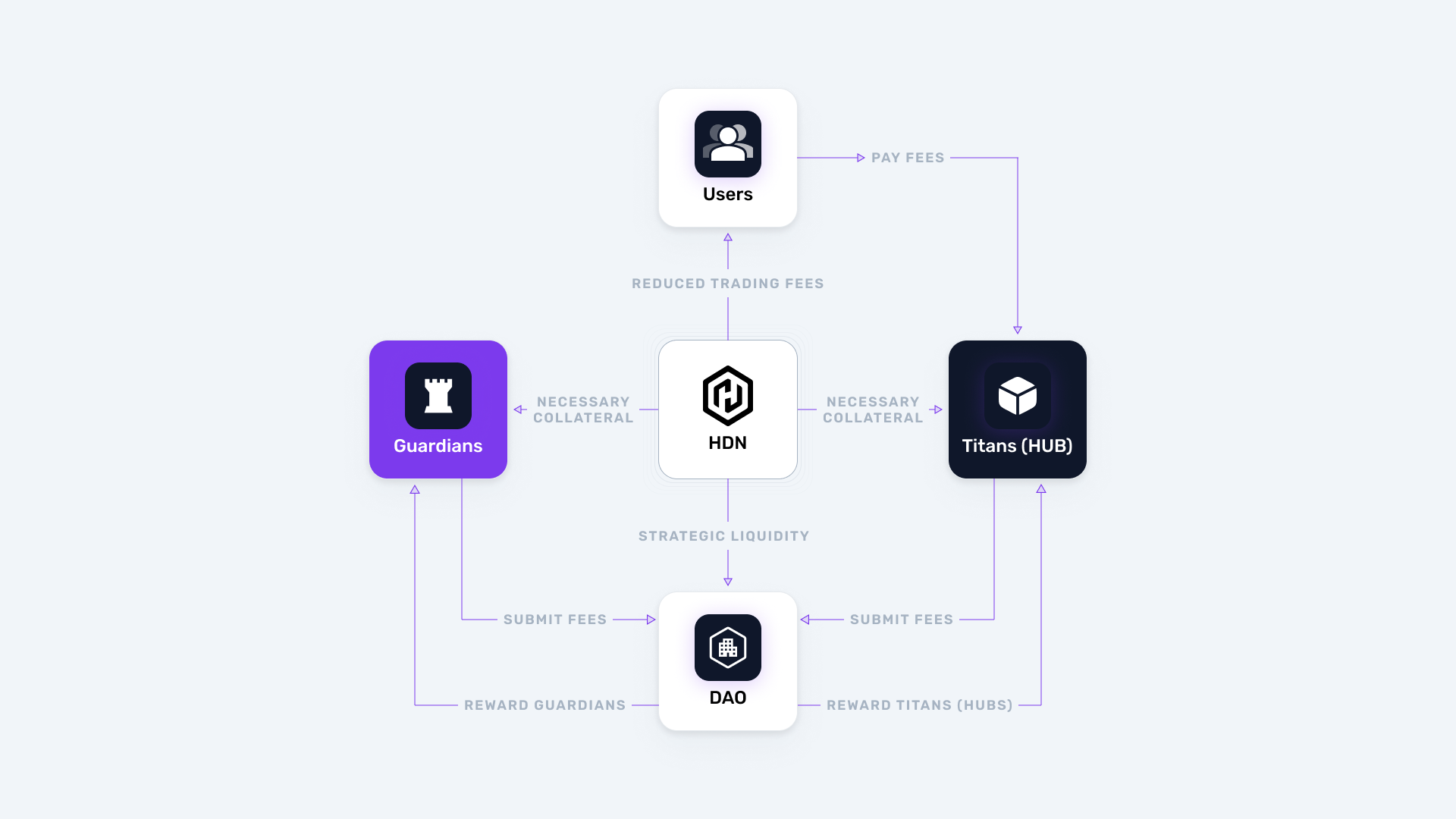

3. Hydranet Trading Fees Overview

The Hydranet DEX enables instant off-chain, peer-to-peer trading with a flexible fee range up to -0.3% for makers per trade, depending on the trading pair and trading activity.

- Negative fees apply to liquidity providers once their liquidity is being used, meaning they receive a small rebate instead of paying a fee, similar to how Uniswap incentivizes liquidity provision. Note: Negative fees are exclusive to liquidity providers and do not impact the share of fees allocated to Titans, Guardians, or delegators.

- All trading fees are initially collected by Titans (hubs) and forwarded to a multi-signature wallet managed by Hydranet DAO-designated signers. This wallet temporarily represents the DAO until full automation via smart contracts and AI governance is established.

- In later development stages, Titans will be able to set their own trading fees, creating a competitive environment that rewards operational efficiency, user trust, and service quality—while maintaining baseline standards defined by the DAO.

Although all trading fees are forwarded to a DAO-controlled wallet and redistributed according to the network-wide fee distribution model, each Titan’s share is proportional to their generated fees. This means Titans are incentivized to attract trading activity—e.g., by offering lower fees or better uptime—since their payout depends on their contribution to the total pool of collected fees. Titans that earn more fees receive a larger portion of the redistribution.

3.1 Fee Usage and Distribution

Trading fees collected on the Hydranet DEX are used to reward network infrastructure operators—primarily Titans (hubs) and Guardians (watchtowers)—and to strengthen HDN token liquidity. At mainnet launch, only a very limited number of hubs may be operational. Until the Hydranet Network is live and network roles can be independently operated by community members, all trading fees will be directed entirely toward treasury, buy-backs and strategic liquidity.

Once the network matures and these roles are broadly adopted, a delegation system is being explored, which will allow HDN holders to earn a share of rewards by delegating their tokens to node operators. This will also allow users with smaller budgets to earn proportionate rewards. Until delegation is activated, the portion of fees originally intended for delegators will instead be used for HDN buy-backs, effectively reducing the circulating supply.

At first, fees may be converted into any supported currency such as HDN, ETH, BTC, USDC and distributed on a 7-day cycle. In later stages, smart contracts will take over, automate the distribution process and possibly offer the option to set the preferred payout currency.

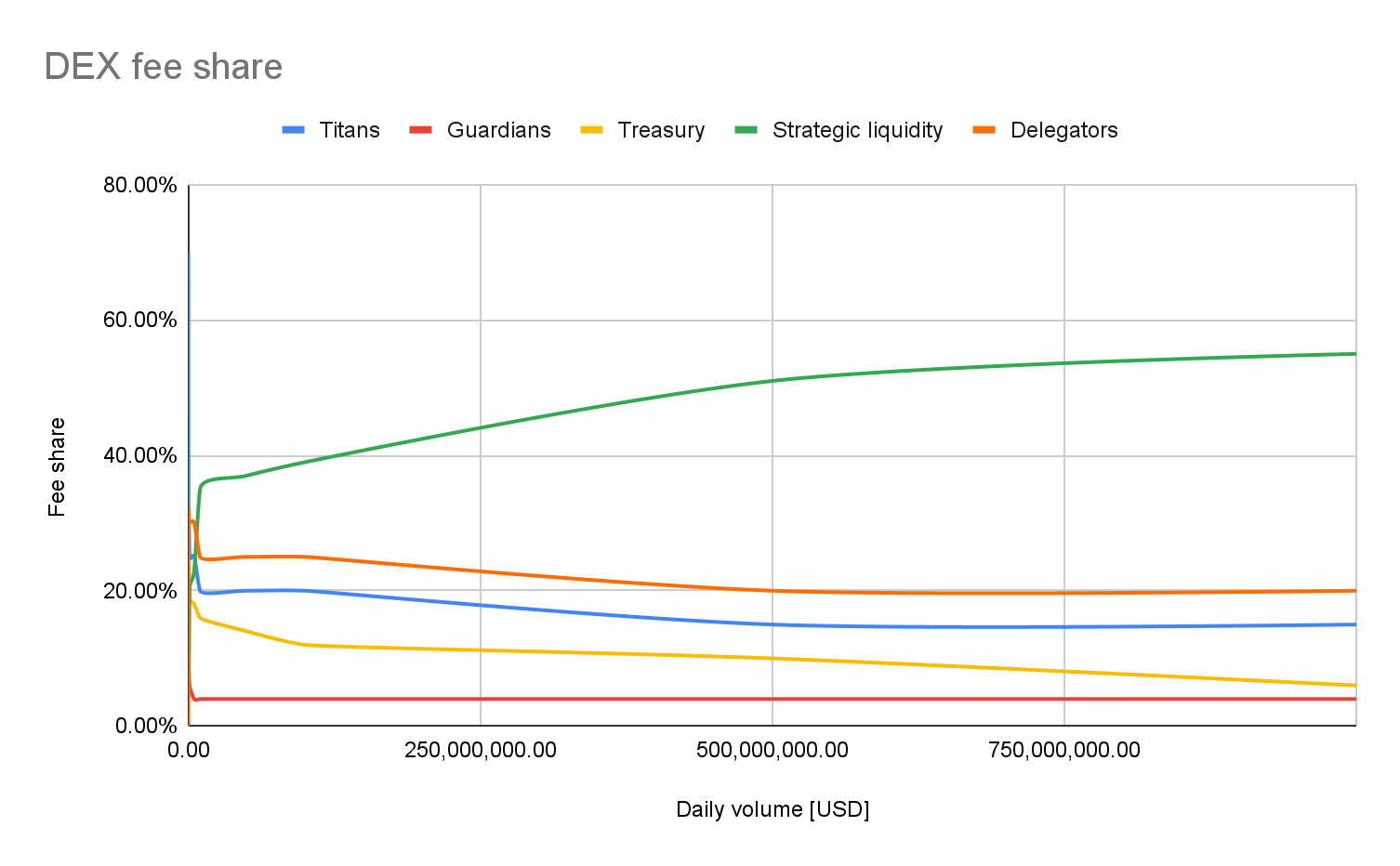

The following models visualize how daily trading fees (assuming for example 0.2%) are distributed across network roles and ecosystem functions based on trading volume. Until the Hydranet Network is live, a 7-day average will be used for each cycle‘s volume.

| Volume [USD/day] | Fees [USD] | Titans | Delegators | Guardians | Treasury | Strategic liquidity |

|---|---|---|---|---|---|---|

| 0 | 0 | 70 % | 0 % | 30 % | 0 % | 0 % |

| 100,000 | 200 | 30 % | 30 % | 10 % | 22 % | 8 % |

| 500,000 | 1,000 | 30 % | 30 % | 8 % | 23 % | 9 % |

| 1,000,000 | 2,000 | 25 % | 30 % | 6 % | 19 % | 20 % |

| 5,000,000 | 10,000 | 25 % | 30 % | 4 % | 18 % | 23 % |

| 10,000,000 | 20,000 | 20 % | 25 % | 4 % | 16 % | 35 % |

| 50,000,000 | 100,000 | 20 % | 25 % | 4 % | 14 % | 37 % |

| 100,000,000 | 200,000 | 20 % | 25 % | 4 % | 12 % | 39 % |

| 500,000,000 | 1,000,000 | 15 % | 20 % | 4 % | 10 % | 51 % |

| 1,000,000,000 | 2,000,000 | 15 % | 20 % | 4 % | 6 % | 55 % |

This model is designed to generate higher rewards for higher HDN commitment while maintaining long-term token stability and avoiding unnecessary inflation.

3.2 Strategic Liquidity

A share of DEX trading fees—ranging from 0% to 55% depending on daily volume—will be allocated toward building strategic HDN liquidity, as shown in the fee distribution table (Section 3.1). This mechanism activates immediately and scales with platform growth.

The core objectives are to:

- Build deep liquidity in HDN pairs across both DEXs and CEXs

- Enable seamless HDN trading by providing reliable liquidity

- Reduce circulating supply through HDN buy-backs

- Establish and grow channel rental liquidity to support efficient trading on the Hydranet DEX

Liquidity Management Tools:

- Run Market maker bots on order book exchanges (Hydranet Exchange and CEXs)

- Liquidity positions deployed on decentralized exchanges (DEXs)

Strong HDN liquidity fosters price stability, usability, and holder confidence. Once the community agrees liquidity levels are sufficient, excess acquired HDN may be transferred into the HDN Vault to reduce supply.

To ensure agility, the Multi-sig team may adjust LP allocations dynamically without a DAO vote. All liquidity actions will remain publicly trackable through the DAO’s Protocol-Owned Liquidity (POL) wallet.

3.3 Hydranet DAO Treasury

DEX fees collected by the Multi-sig will be allocated toward essential operations that support the long-term success of the Hydranet ecosystem:

- Platform Development

Funding the continued development and maintenance of the Hydranet platform, including infrastructure costs, developer compensation, recruitment, training, and research & development. - Marketing & Branding

Promoting Hydranet and educating users on blockchain technology through targeted campaigns, community outreach, and advertising in relevant channels. - Referrals & Community Incentives

Rewarding community members, influencers, and ambassadors who help expand the ecosystem through referral programs and promotional efforts. - Legal & Compliance

Covering legal counsel, regulatory filings, and compliance-related efforts to keep Hydranet legally secure across evolving jurisdictions. - Emergency & Reserve Fund

Maintaining a financial reserve to respond to unexpected events, ensure operational continuity, and support over-the-counter (OTC) deals when strategically beneficial.

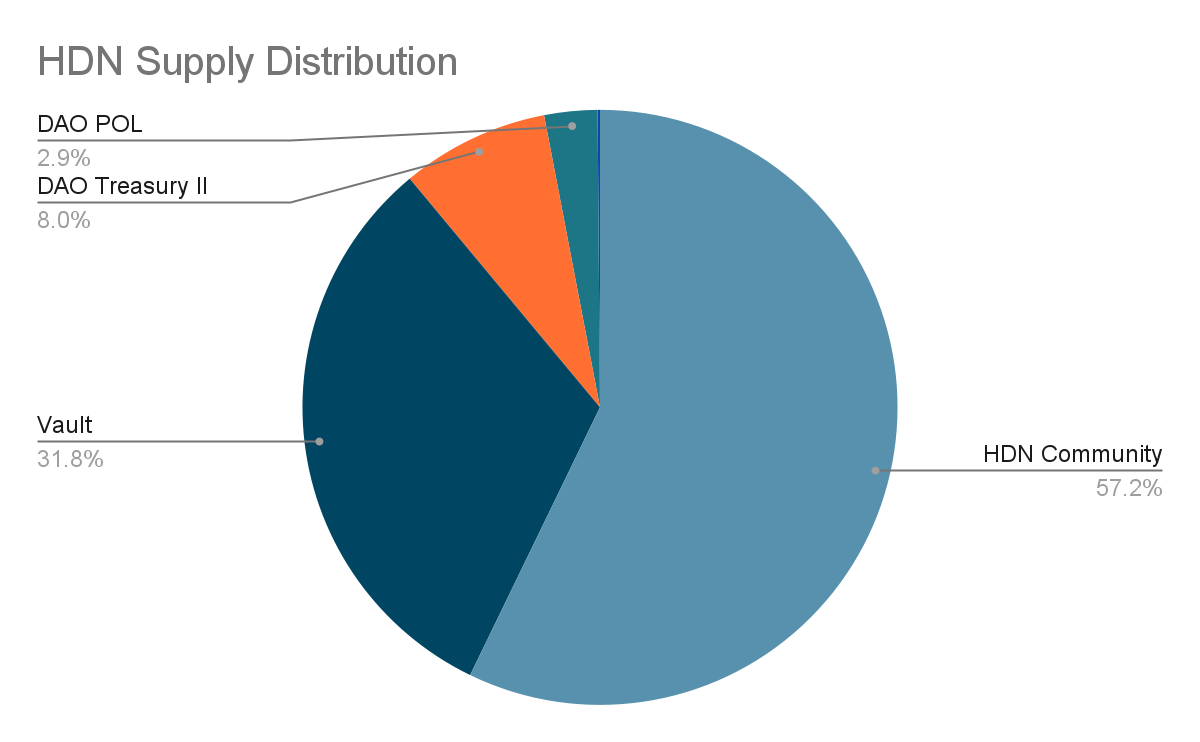

4. HDN Supply

Snapshot of the HDN supply distribution in June 2025:

- 95.3 Million: Vault (Holding all non-circulating supply of HDN to be used at the discretion of the DAO, any unlocks need to be approved by DAO votes)

- 8.7 Million: DAO Protocol-owned Liquidity (POL) (Holding liquidity assets of the DAO, used for providing liquidity on exchanges):

- 24.4 Million: DAO Treasuries (Holding all treasury assets of the DAO, used for paying services, external devs, team members, marketing expenses, reserves for OTC)

- 171.6 Million: Hydranet Community

5. Additional Info

The Hydranet DAO will continuously refine the HDN tokenomics, propose new features, and adapt to evolving legal and technical insights. Minor changes — such as typo corrections, grammar improvements, or updates reflecting DAO votes — may be implemented without prior notice. As the ecosystem expands and new products or participants emerge, more substantial revisions to the tokenomics may be proposed and adopted through DAO governance.

5.1 Arbitrum Network Info

Network Name: Arb1

RPC: https://arb1.arbitrum.io/rpc

Chain ID: 42161

Currency Symbol: ETH

Block Explorer URL: https://arbiscan.io/

5.2 HDN Token Info

Smart-contract: 0xB0F66Bdb39acBb043308eb9Dbe78F5bB47ea5430

Disclaimers

Legal Notice & Disclaimer

The information in this document is provided for general informational purposes only and is based on estimations deemed reasonable at the time of writing. It does not constitute legal, financial, investment, tax, or other professional advice. All projections and figures are subject to change depending on participation levels and other variables that cannot be predicted until the network is live. The Hydranet DAO, its contributors, affiliates, and partners make no warranties or representations, express or implied, regarding the accuracy, completeness, or reliability of the information presented herein.

Nothing in this document constitutes a solicitation, offer, or recommendation to buy or sell any assets, including the HDN token. The HDN token is not intended to be a security, commodity, or any other regulated financial instrument.

The Hydranet DAO is a decentralized collective and does not operate as a legal entity, corporation, or partnership in any jurisdiction. Any reference to the “Hydranet DAO” is descriptive and does not imply a unified or registered legal structure. Participation in the DAO or use of its platform is entirely voluntary and at the user’s own risk.

The regulatory treatment of digital assets varies by jurisdiction and may change over time. It is solely the responsibility of users and token holders to comply with applicable laws and regulations in their country of residence.

Hydranet does not provide services in jurisdictions where doing so would violate local laws or regulations, particularly those under AML, CTF, or sanctions regimes. The DAO reserves the right to restrict access based on jurisdiction, conduct, or other risk factors.

Use of this document, platform, or ecosystem constitutes acceptance of these terms. Always consult a licensed legal or financial advisor before making decisions involving blockchain assets.